Valued Representation Services

How much is your business worth?

The #1 question asked by nearly anyone who has an interest in your business, especially you!

The Fair Market Value and the Strategic Value can say a lot about your business and can influence the future course of your goals. A good business valuation serves as a key indicator of the health of your business and highlights the important value drivers which affect business value.

However, not all valuation reports are created equal, so you need the right report for the right reason, and more importantly, you should know how the value of your business is determined. You want peace of mind, confidence, and trust that the value of your business is determined by using industry best practices and follows established guidelines and procedures for formal valuation reporting.

We are certified business appraisers and we understand the importance of performing a professional assessment of your business value.

When is the best time to sell my business?

The best time to sell is when a business is doing well. It is best not to wait until after a business has peaked; the selling price can suffer.

However, almost any business can be sold, even if it is not doing well, if the sale is handled professionally and priced correctly.

I am planning to sell my business in the next two years. What steps should I be taking now to assure a smooth (and profitable) transition?

Business buyers always confirm the financial standing of a business during due diligence.

Are you ready to Buy a Business?

In most cases, our recommendation is that you buy an established business, as 57% of “new” businesses fail within the first 3 years.

While an established business has a built-in market base with recurring revenues, proven products or services and tested locations. Most of the time, an established business can be successfully transferred through adequate training and a planned introduction to employees and existing customers and vendors.

And often, new owners take their recently acquired business to the next level by injecting fresh ideas, better management and a renewed energy and passion.

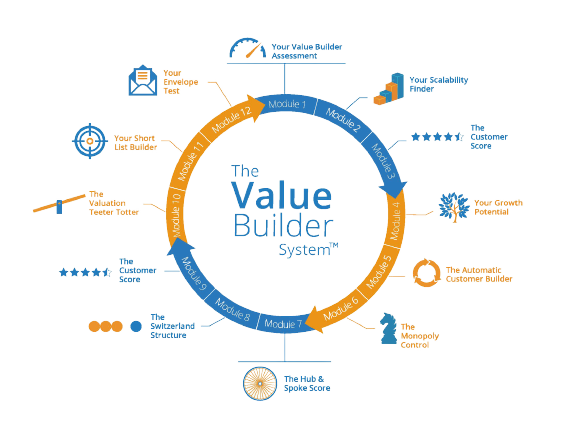

The Value Builder System

The Value Builder System is a statistically proven methodology that focuses on 8 key factors to improve the overall value of your business.

We track and analyze your financial performance, cash flow, growth potential, revenue streams, marketing activities, customer satisfaction, key dependencies and company structure, in order to create both business and financial value.

VR is Valued Representation

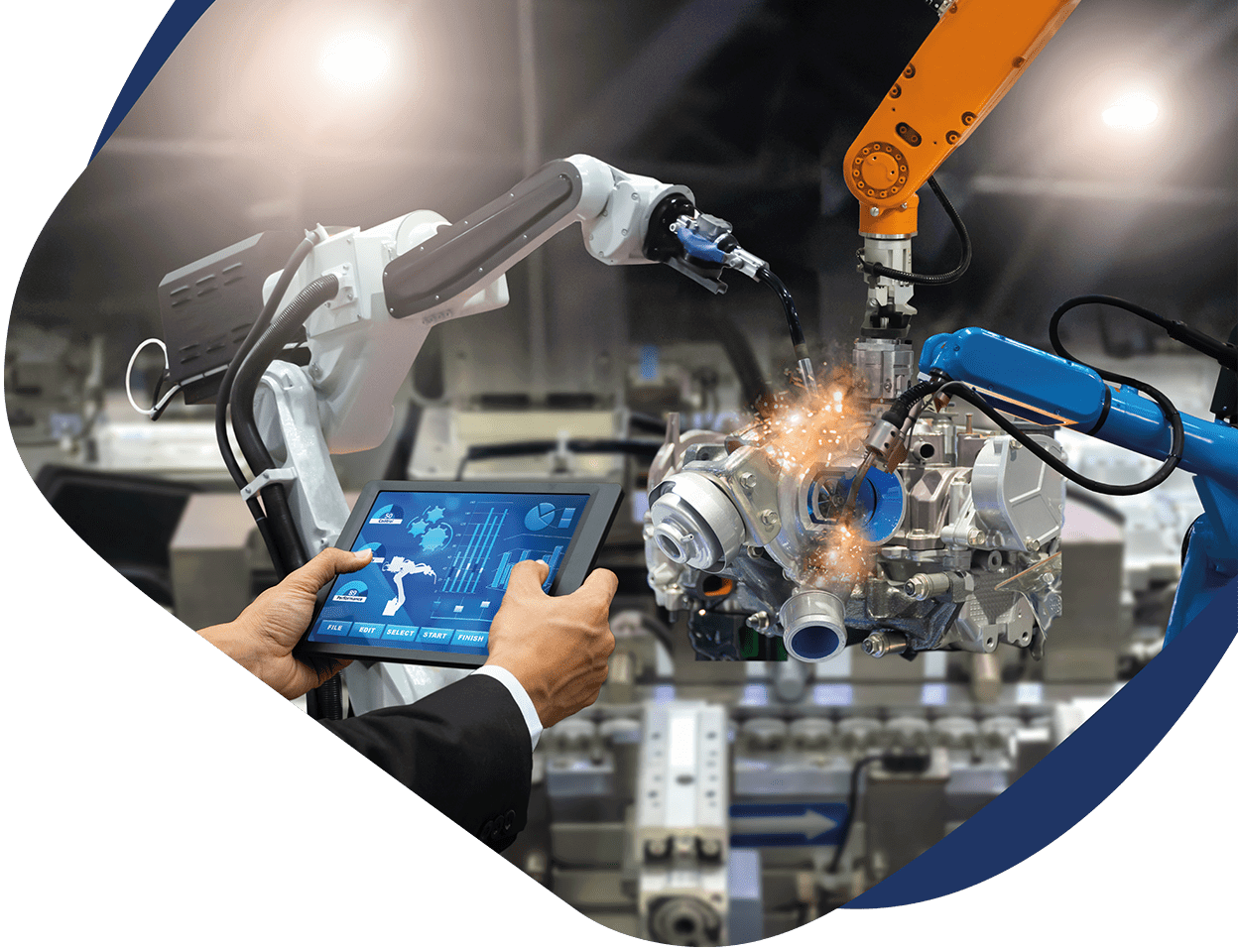

The entrepreneurial boom has changed the face of business worldwide. The thousands of companies that make up the middle market are critically important to economic activity and job creation.

Inside this spectrum, one can observe entrepreneurial behavior, ranging from product development and manufacturing, to leveraging of technology, to market expansion. This lifeblood is the driver behind the growth of mid-sized companies.

Where is the next mid-market company that is developing a technology that will not just capture a market, but create one? Where is the organization that has improved its operations, increased its profitability, grown its work force, and now needs options to advance past its competitors?

Looking for Businesses in Your Location?

VR Has Sold More Businesses In The World Than Anyone.®

Our advanced business for sale search feature allows you to search by industry type, business size ranges, revenue ranges, earnings ranges, as well as by state or county.

To find the businesses for sale you are interested in, it is best to start with a broad search and then narrow it down. You can pick very specific industries or select the all category (e.g. Manufacturing, All) to search all of the businesses for sale in a particular category.

Welcome to VR Business Brokers of St. Louis!

Valued Representation… It’s the meaning behind our name; it’s what we deliver to every client.

Plan Your Exit!

VR Business Sales and Mergers & Acquisitions is proud of our heritage as the leader in sales and transfer of privately-held businesses since 1979. We are even prouder knowing that we have helped many families live the American dream of business ownership. These same people are those who make up our local business communities in every town and city and who drive job creation and our economy. Call us today and let one of our trusted advisors answer your questions and show you how Valued Representation can help you realize the American dream!

Managing Partner VR in St. Louis

Featured Listings

We are

Our advanced business for sale search feature allows you to search by industry type, business size ranges, revenue ranges, earnings ranges, as well as by state or county.

To find the businesses for sale you are interested in, it is best to start with a broad search and then narrow it down.

You can pick very specific industries or select the all category (e.g. Manufacturing, All) to search all of the businesses for sale in a particular category.

VR Has Sold More Businesses In The World Than Anyone.®

Latest News and Updates

Now you can be updated daily on business sales, valuation techniques, mergers and acquisitions, career opportunities with VR, and much more.

Be the first to find out about new businesses for sale, and what has just sold.

Subscribe to Receive Updates.

Subscribe to Our Newsletter

"*" indicates required fields